%This code is written by Tanmay Dutta

function val=ABM_simulation(time,step)

delta=(time/step)^0.5; %This is how we define the delta in BM

p = 0.5; % probability of random walk up or down

val=zeros(1,step);

u=zeros(1,step);

for i=1:numel(u)

u(i)=rand;

%%%%% NOTE ' ' NEAR GREATER AND LESS SIGNS. IF

%% YOU WANT TO REUSE THE CODE REMOVE ' ' IN NEXT LINE

val=delta*(p'<'u)-delta*(p'>'u);

end

for k=2:numel(val)

val(k)=val(k)+val(k-1);

end

val(1)=0.00 % Because B(0) =0 always

end

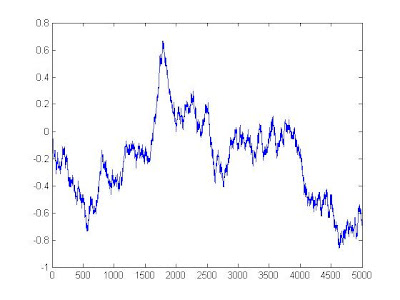

One simulation result for my code :

(Simulation on T=[0-1] and step = 5000)

(Note that the level goes below zero too, hence it can not be used for stock modeling and we need geometric Brownian motion with drift for that case )